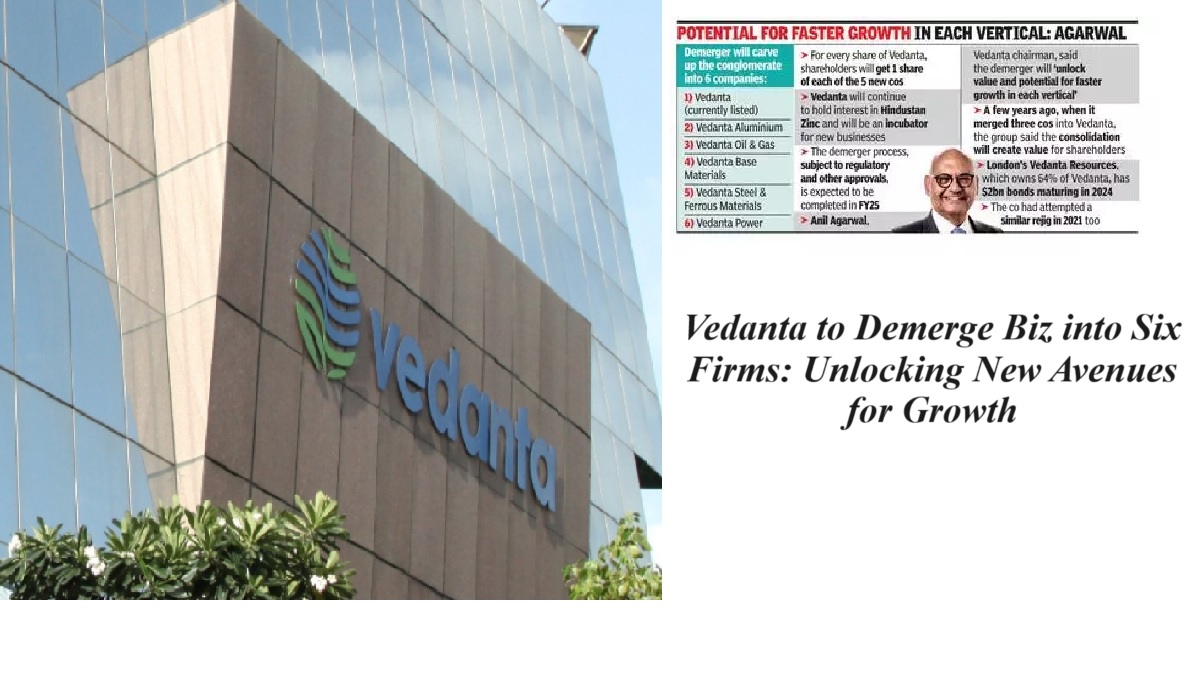

Within the fast-paced world of commerce, flexibility and key advancement are key. Vedanta Constrained, a driving worldwide broadened common assets company, has as of late declared a groundbreaking choice that has sent swells through the corporate scene. The company is set to demerge its commerce into six unmistakable firms, a move that guarantees to rethink its future direction and open modern roads for growth. In this web journal, we’ll dive into the complexities of this vital move, investigating the reasons behind it, its potential affect, and what it implies for Vedanta and its stakeholders.

Understanding Vedanta’s Vision: A Key Demerger

1. The Beginning of the Decision

Vedanta Restricted, known for its differentiated portfolio in metals, mining, and vitality, has chosen to streamline its operations by making six free substances. This choice stems from a fastidious assessment of showcase patterns, industry requests, and inside capabilities.

2. The Unraveling of Vedanta: Commerce Units Defined

The demerger will result in six centered firms, each devoted to a particular division. These segments include mining, metals, oil and gas, control, press and steel, and aluminum. This vital division will empower each substance to concentrate entirely on its space, cultivating specialization and innovation.

3. Grasping Specialization: Driving Advancement and Excellence

By concentrating on particular divisions, Vedanta points to cultivate advancement and greatness inside each commerce unit. Specialization permits for a extended understanding of showcase subtleties, empowering the company to cater to advancing client requests effectively.

4. Suggestions for Partners: Financial specialists, Workers, and Communities

Stakeholders, counting financial specialists, workers, and neighborhood communities, stand to advantage from this demerger. Speculators may witness improved esteem as centered substances optimize their operations. Representatives can anticipate expanded openings for development and improvement inside specialized spaces. Nearby communities may advantage from economical hones and community-centric initiatives.

5. Exploring Challenges: Tending to Potential Concerns

While the demerger holds guarantee, challenges are inescapable. Vedanta is ready to explore these challenges by actualizing vigorous methodologies, guaranteeing consistent moves, and prioritizing partner communication.

The Street Ahead: Vedanta’s Vision Unveiled

6. Economical Hones: A Center Focus

Amidst the demerger, Vedanta remains undaunted in its commitment to feasible hones. Each substance will follow to exacting natural guidelines, contributing to the company’s bigger vision of natural stewardship and corporate social responsibility.

7. Worldwide Development: Leveraging Specialization for Worldwide Growth

The specialized approach of the demerged substances positions Vedanta for worldwide development. Leveraging their skill, these firms are balanced to investigate universal markets, fashioning key organizations, and extending their worldwide footprint.

8. Advancement in Mining and Metals: Spearheading Innovative Advancements

In the mining and metals segment, advancement is vital. Vedanta’s demerger will empower centered inquire about and improvement, clearing the way for spearheading mechanical progressions. This center on advancement is set to rethink industry measures and set up modern benchmarks.

9. Enabling Nearby Economies: Community-Centric Initiatives

Vedanta’s commitment to enabling nearby economies remains immovable. Through community-centric activities, the demerged substances will effectively lock in with nearby communities, cultivating financial development, and upgrading the quality of life.

Conclusion: A Strong Step into the Future

In conclusion, Vedanta Limited’s choice to demerge its commerce into six firms could be a confirmation to its key prescience and commitment to economical development. By grasping specialization, fostering development, and prioritizing partners, Vedanta is balanced for a future stamped by victory and resilience.

FAQs

Q1: What provoked Vedanta to elect this demerger?

Vedanta’s choice stems from a intensive examination of advertise flow and inner capabilities, pointing to upgrade specialization and cultivate development inside unmistakable sectors.

Q2: How will this demerger advantage investors?

Investors can anticipate improved esteem as centered substances optimize their operations, possibly driving to expanded productivity and shareholder returns.

Q3: What measures is Vedanta taking to address potential challenges amid the transition?

Vedanta is executing strong procedures, guaranteeing consistent moves, and prioritizing partner communication to explore challenges effectively.

Q4: Will this demerger affect Vedanta’s commitment to feasible practices?

Not at all. Vedanta remains immovable in its commitment to feasible hones, with each demerged substance following to rigid natural measures and corporate social duty initiatives.

Q5: How does Vedanta arrange to lock in with nearby communities post-demerger?

Vedanta’s demerged substances will effectively lock in with nearby communities through community-centric activities, cultivating financial development and upgrading the by and large quality of life.